In this pandemic, most of us turn to online shopping for help. It’s a lot easier, you don’t have to leave your house and you get the bonus of letting others do your chores for you. An introvert’s dream, honestly. But amidst the groceries, your eye catches something else. After all, you can’t just be shopping for kitchen essentials all the time, right?

What about you? What about your needs?

So, you scroll through Shopee or Lazada or other online platforms with the intention of “just looking”. You keep telling yourself you don’t need that eyeshadow palette, it’s not like you’re going out anytime soon. You don’t need that jellyfish lava lamp either, but it looks so quirky and cute. So, you add it to your cart.

When you finish browsing, your curious mind tells you to see how much all of the purchases cost. Just to check, and oh. That’s pretty cheap. Your finger hovers over the checkout button.

Maybe just this once, you tell yourself.

Oh how naive. You don’t realise the power online shopping has over you. Everything is just so easy. A couple of clicks and all you have left to do is to wait.

But sometimes, things get out of hand. On one hand, you’re scared to check your bank account but on the other, you’re not scared to click purchase. Make it make sense.

So, from one shopaholic to another, let me help you save up a little bit so you can feel a tad bit guilt free the next time you get hit with the urge to shop.

1. Plan a Budget For the Week

Once you get your salary, always pay off your bills and loans first. Afterwards, you can plan on budgeting the rest of it.

A month seems too far out of reach for some (read: me). We don’t know what the future holds and we’re not that strong, let’s be honest. So, baby steps work best.

Plan your week. Decide what you want to spend on each day and allocate a budget for it. Start off by what’s most important and leave the lesser ones at the back. It’s key for you to be strict on yourself and try your hardest to not go over the budget you set up if you can help it.

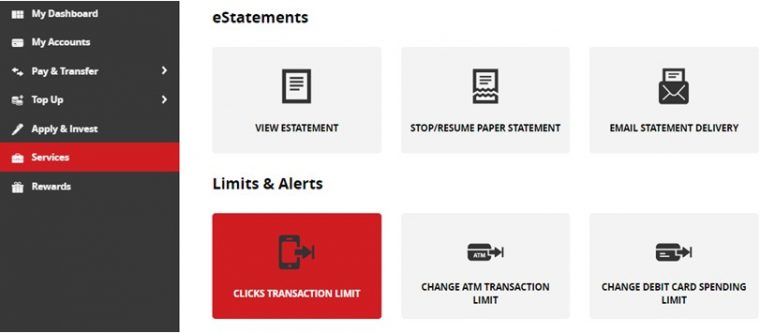

2. Limit your ATM/Online Transactions

We all know how easy it is to buy things online nowadays. All it takes is a single click and a week later, the postman’s calling your name with your purchase in his hands.

I myself am a victim of online shopping and to prevent myself from overspending on the dumbest things, I put a limit on my online transactions. I leave room for my bills and such and also a few ringgit for my own shopping just so I don’t deprive myself. But other than that, it’s all going in my savings and I’m not allowed to touch them.

I do very much understand the saying of “why make money if you can’t spend it?”. Trust me, I do. But there is a limit to how much you can spend before you’re eating Maggi for the rest of the month. Aren’t you tired of that endless cycle?

3. Use cashback apps

These apps help a lot in saving money. Once you spend a certain amount, you get a few percent of cashbacks and can use it for your next purchase. Sometimes, I get a product for free because I get a lot of points from my previous purchase.

Make use of cashback, discounts and coupons to the best of your ability. The more you collect, the lesser amount you’ll have to pay.

Speaking of points, some apps that you can download for cashback are Shopback, Shopee and Grab.

4. Meal prep

Sounds easier than it is. Eating the same meal everyday gets pretty boring sometimes, but you should’ve thought of that before you went off and spent the money that was supposed to be for food on those new shoes. Where are you even going? You’re in the middle of a pandemic!

On a serious note: if you find yourself short of money, you could always meal prep next time to make sure you don’t have to worry about what to eat for the rest of the week. Allocate a day where you just buy groceries and make meals that could last you the whole week.

There are easy recipes you can follow to help prep your meals for the week.

Keep the meals simple and you can tweak it to your heart’s content whenever you want if it seems too bland for you when it’s time for you to eat it.

5. Marie Kondo your things

Since you’re so good at buying things, who’s to say you’re not good at selling them?

Aren’t you already a pro from seeing consumer behaviour? Seeing as you are a consumer yourself.

Pick out things from your room or house that don’t spark joy in you anymore and try selling them online. Make sure they’re in good condition and use your sweet talking skills to your advantage.

You can sell your items on carousel, mudah.my and even Shopee.

Bonus point: Save RM5 every week. Put the money in a tabung or a container somewhere and don’t touch it. By the end of the year, you could probably buy a house with how much RM5 you’ve collected.

I had just started doing this last month and have been trying to collect more. The trouble here is, I rarely go out and have not been carrying cash around with me. A substitute for this is by using bank apps that helps you put a certain amount in your tabung every week.

You can also set a goal of how much you intend to save for the week or month and the app will tell you once you’ve reached it.

Practice Makes Perfect

Some things are just meant to be left alone. And I’m talking about the money left in your bank account. Don’t touch it unless you absolutely need to. Saving money is hard but it’s for your own good.

Sometimes you have these impulses that tell you to buy things. It’s like you blacked out for a second and when you come to, you’re in front of your laptop with your card in hand and your finger hovering over the checkout button. It’s never too late to start saving.

Here are some other tips on how you can budget:

Money on My Mind: Budgeting and Where We Fail