As the year draws to a close, your news feed is probably filled with heaps of New Year Resolution posts for 2020. You have friends who promise to attend yoga daily, some would like to quit drinking milk tea, others swear to eat healthier or travel to Europe, but we all know what you really want – a good night’s sleep.

Your Eye Bags Are Designer

You’ve summoned up the strength to put down your phone after 10 pm, but your clingy insomnia is starting to make you wonder, “What’s keeping me up tonight?”. Was it almost spilling hot coffee on Susan this morning? The nail-biting prospect of the quarterly review going wrong? Perhaps your boss has found out you’re stealing biscuits from the pantry!

Anybody’s guess is as good as yours.

If you’re like many Malaysians in your 20s, troubling insomnia can be easily attributed to either:

1. Your roommate driving you bonkers by blasting Westlife’s new album at 3 am (you don’t care if it’s lit)

2. The LRT was late today and you stood next to someone critical body-odor issues (the trauma lingers)

3. And the most daunting part? The thickness of your wallet is getting unsettling (reminder that Susan owes you from Nando’s last month)

If you’re like us – losing sleep over your financial woes – we’ve got bad news for you. New Year is right around the corner!

Does It Pay to Be Prudent?

The truth about 21st-century living and dining in an urban area is this: simply being alive is expensive.

You’re spending RM350 on a room that can fit three Kancils, food is probably setting you back by RM400, utility bills at RM200 whereas groceries and petrol drain around RM300-500.

You’re looking at a remaining RM600, perhaps half to pay off your Axia loan and another half to sleep well knowing that you’ve settled the tip of your PTPTN debt iceberg. You don’t work for Google, you get the point.

Our Struggling Middle Class

If you consult the numbers, the cost of living has risen since your parent’s time (big shocker to you, I’m sure).

With modern consumerist culture and increasingly targeted advertising, saving up has become just as difficult as keeping up with the Joneses. Making up 60% of the working economy, Malaysian millennial have been cited to have poor initiative for investing. This spells trouble for our future financial state, in addition to the chaotic state of budgeting we’re trying to keep up with, in the present.

Paying the Price

There are many methods to gauge the national cost of living. Among the popular methods are through the use of the Consumer Price Index (CPI). In November 2019, the Department of Statistics Malaysia unveiled a 0.9% increase in CPI as compared to November 2018. Although the accuracy of estimations may vary, one thing is for sure: Malaysians are holding back on their discretional spendings.

Depending on your income level, there’s probably a different cheapskate’s guide to managing the damage to your wallet. Yet, as you may suspect – there are a few golden budgeting rules to heed, of course.

The Local Penny Pincher

Have you ever been so broke to a point where the five-second rule means nothing to you?

It even stops bothering you that the fried chicken you dropped on the couch has been there long enough to form a stain the shape of Brazil; A sure-fire way of keeping that RM120 splurge at Nando’s from coming back to haunt you is this – don’t go grocery shopping on an empty stomach! According to new research, being hungry arouses your desire to acquire things. Alternatively, you could also price check your grocery list using apps like Hargapedia and only visiting malls during weekend sales!

Home Sweet Home

If you’re classified as a Malaysian Youth, you’re in luck – the government has just cut you a break in Budget 2020 for affordable housing!

It’s alright if you don’t though, because if you fall into the middle-income bracket (M40) the Targeted Fuel Subsidy Programme (PSP) for Malaysians has just been extended. However, you’re not out in the clear yet. The crucial ways to navigate around deductibles for rent can range between haggling around the initial offer or simply finding a roommate to split costs with!

The 50/30/20 Budgeting Rule

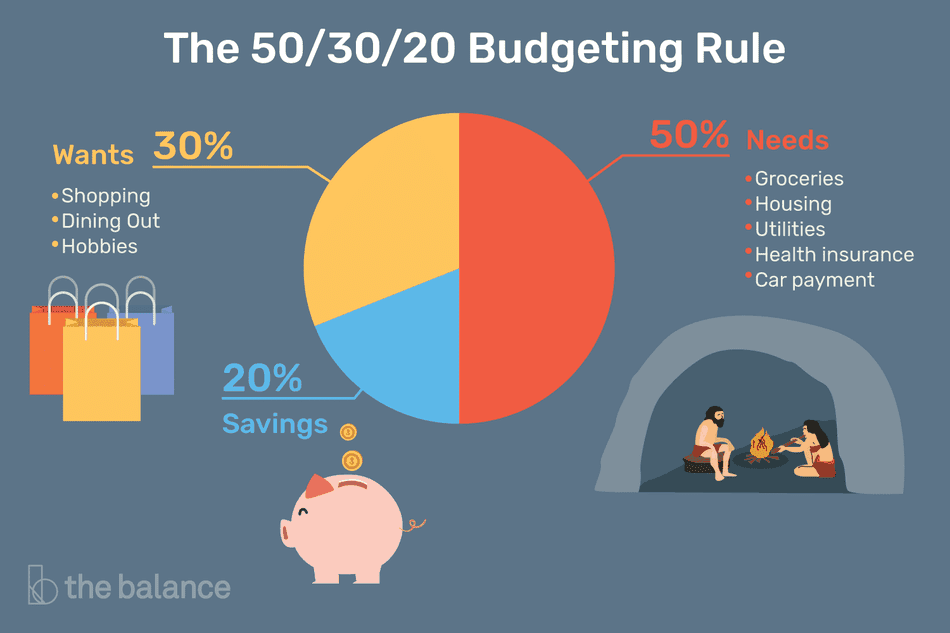

According to the 50/30/20 budgeting method, you should only spend 50% on fixed costs. This includes utility bills, rent, parking seasonal pass, mortgage, and internet subscriptions. If you earn RM3,500 a month, that’s a maximum of RM1,750 allocated to paying your essentials such as PTPTN, Netflix and of course – your new metallic red Myvi loan.

Scrimp or Splurge

Growing up, we’re taught to set a goal to work towards; but look at it this way, the promise of a week-long trip to Taiwan will help you to resist buying those new Nike shoes. Draft out a budget in your notes with what you’re saving up for and open it up when you’re tempted during seasonal sales. Anyhow, the rule of thumb is to postpone your purchase by a month. Chances are you’ll have lost interest in the item and hopefully realize it wasn’t entirely necessary.

Your Wallet, Your Rules

With the ease of e-wallets on the rise, clinging to the wreckage seems tempting. Needless to say, learning to manage your wealth in this challenging economic time will help to stop you from pouring money down the drain.

There’s no time like the present to pull off a giant U-turn and organize yourself a financial intervention. Besides, how are you going to live up to be a Crazy Rich Asian if you don’t? As our luck would have it, we’re being spoken up for. Read more about how the government is easing the burden on millennials in 2020 here.