About 5 minutes ago, your friend told you his company is enforcing a 50% pay cut. You told him everything’s going to be alright.

Then you found out your cousin’s job is hanging by a thread. He works in Singapore. The border has been clamped shut. He’s no longer able to cross and his company can no longer pay for his absence. You prayed for him.

But when the bad news hits home, you find yourself out of words, out of hope.

News like these, they go on and on. In fact, the internet today has more doom than dynamic while the TV is simply not helping.

In Awani, it was reported that the UN is expecting 195 million people worldwide to lose their jobs by the second quarter of 2020.

With all this depressive information doing more harm than good, you wonder. Maybe it’s time to take a step back and figure out ways to call for help, financially.

You may be doing okay but what about those that are actually struggling?

Those who lost their jobs? Those without food today or those who had to shut their small time businesses down?

Help is Actually Here

Let’s be absolutely clear – yes the situation is bad but this isn’t the first time Malaysia has been in a financial crisis.

On a bigger scale, there was the mid 80s crisis. You remember how your uncle who just got back from the states for his Master became jobless for so long he had to grab whatever job available.

Then there was the 97/98 Asian financial crisis and how hard life was when your parents had to struggle to put food on the table.

The most recent one would be the 2008 global financial crisis. You remember clearly because you’re old enough to have responsibilities.

But the things is, there were always measures put in place to. The government initiated plans and packages to help recover, stimulate and grow the economy. And somehow these plans worked.

PM Tan Sri Muhyiddin Yassin last month announced an economic stimulus package (PRIHATIN) made exclusive to mend the wounds from the pandemic. He also announced an extension of the package to help SMEs continue to run the show.

Prior to that, ex-PM Tun Mahathir Mohamad also launched an earlier stimulus package not only to mitigate the impact of COVID 19 but also to spur rakyat-centric economic growth.

So as the rakyat, you’re stuck in a financial rut, what are your options? Where do you go for help?

Although there are many aid offered under the new package, here are three financial assistance programs you may choose to cover your losses during these hard times.

1) EPF i-Lestari

Basic Rundown

Now you can take out some money from your EPF for 12 consecutive months.

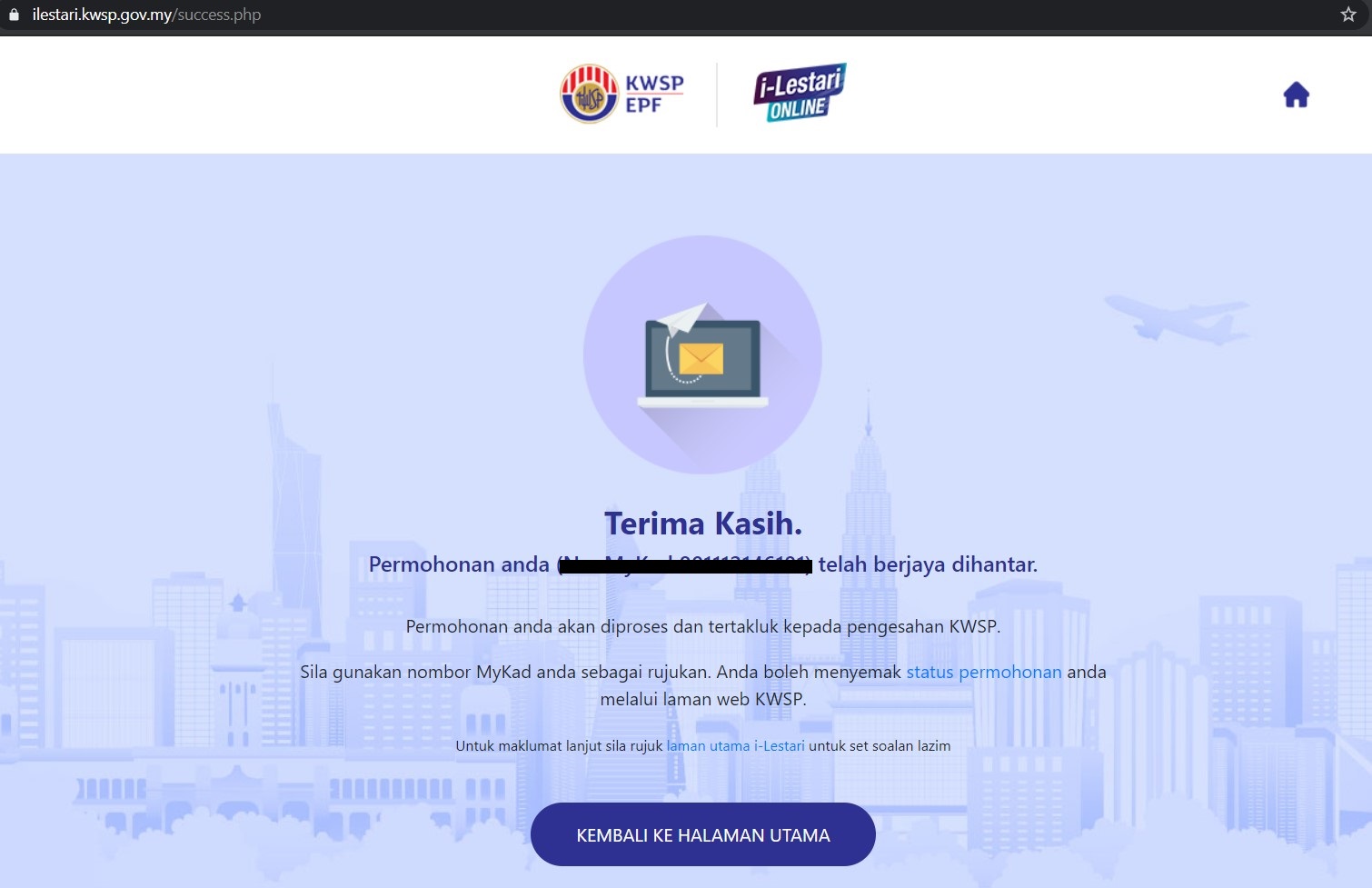

Called i-Lestari, the Account 2 in the Employees Provident Fund (EPF) can now be withdrawn to help soften the impact of the economic bump. You’re now allowed to systematically break your piggy bank from a value of RM50 to RM500 a month. Payments will be credited from May 2020.

How?

Since a lot of EPF members have not set up their i-Akaun (online access to its service) and to set one up requires a member to physically register at a kiosk (dangerous option now), the new i-Lestari service allows you to register AND apply for the withdrawal with only a few clicks. Trust us, the site is super easy to manoeuvre. If you’re interested, click HERE to start.

Keep in mind though. You’re still breaking your OWN piggy bank so the takeaway here is not to spend the extra dough lavishly. Save it, invest in it, roll in for bigger returns.

2) Bantuan PRIHATIN Nasional

Basic Rundown

It’s a one-off cash aid targeted at both the B40 and M40 class.

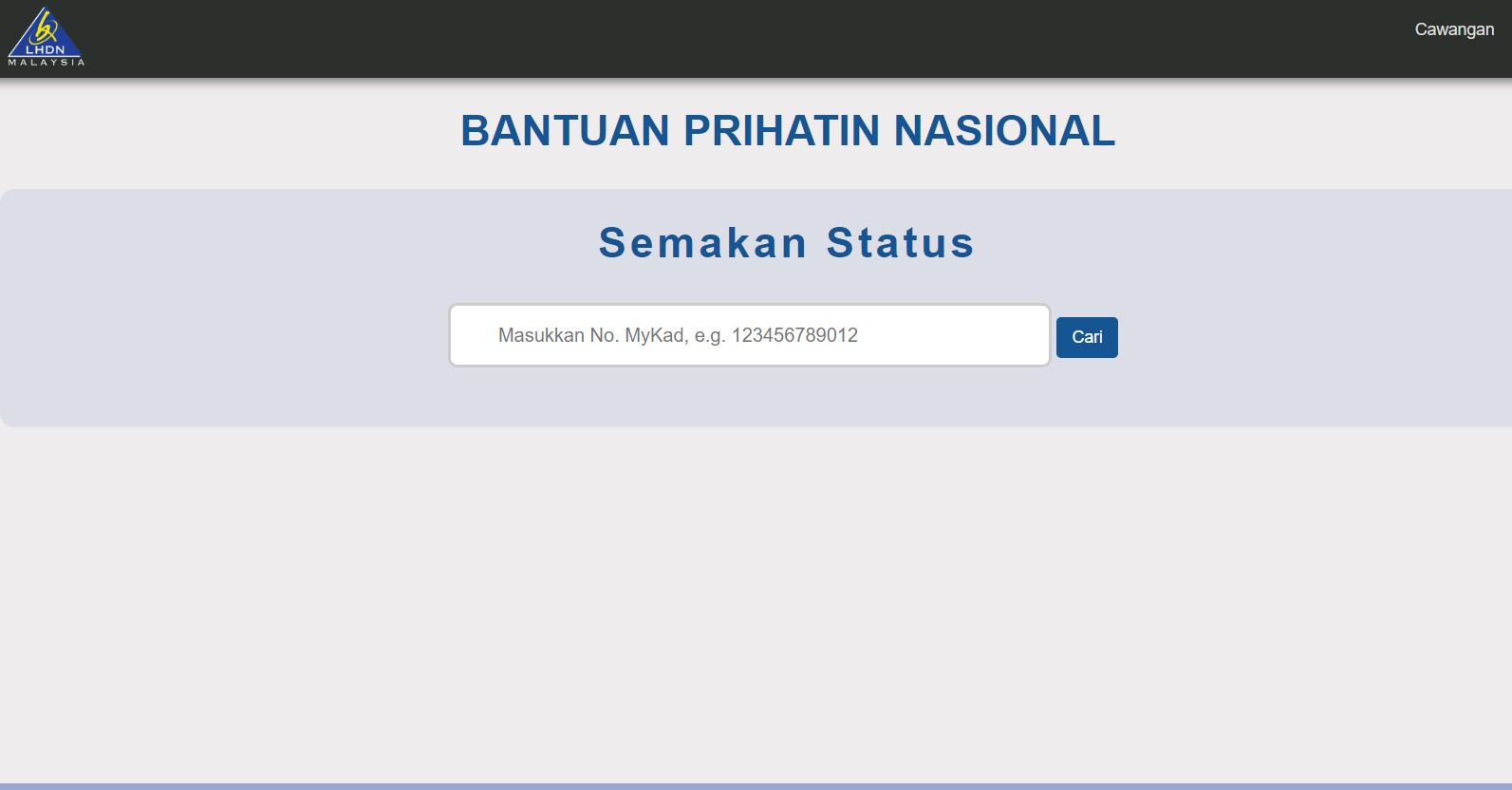

Using the data from the previous Bantuan Sara Hidup recipients, the most talked-about aid, Bantuan PRIHATIN Nasional (BPN) now extends its reach to assist the M40 class or at least some part of the category. The cash aid varies from RM500 to RM1,600 depending on your category.

It covers household income getting up to RM8,000 a month and also singles, earning up to RM4,000 a month.

How?

Registration is quite easy too. Although this fund is operated by the Inland Revenue Board of Malaysia (LHDN), you don’t need to go to the counter to register. You also don’t need to prepare any documents, at all. As a member of the working industry, you’re already contributing to the tax and your data has been stored. To check your eligibility, click HERE.

The site, however, may experience some lag due to the traffic. Do try to keep refreshing if it does so and once successful, an email will be sent as notification.

3) PRS Withdrawal

Basic Rundown

You can now withdraw your savings from your PRS with NO tax penalty.

The Private Retirement Schemes (PRS) is a voluntary long-term savings and investment scheme set up by Securities Commission in 2012 to help Malaysians save for their retirement.

To date, the scheme allows you to withdraw from your savings BUT with an 8% tax imposed. Similar to the government pension scheme, you’re only allowed to withdraw upon retirement.

Under the new stimulus package, however, you can now withdraw up to RM1,500 from Account B from a nine-month period (April to December 2020).

How?

Since PRS is operated by different investment institutions, the method to apply may vary and there’s no central site we could direct you to. So far, there are only eight PRS providers in Malaysia. Click on the links below to apply for the withdrawal.

Affin Hwang Asset Management SB

AIA Pension and Asset Management Bhd

Manulife Investment Management (M) Bhd

Principal Asset Management Bhd

Again, be mindful that you’re breaking your piggy bank on this one. Either save the cash for rainy days or better, invest in it.

It’s a Long Way to Go

Most financial assistance programs under the new stimulus package come in the form of loan repayment relief, discounts, cash aid and allowances. The three above, however, actually comes from your savings.

So always be mindful of what you plan to do. We’re sure upon reading the news, you won’t be surprised how long the rainy days will be so instead of spending it in one go, try to set a controlled spending pace where you monitor your spending diligently.

Remember, it took the nation a good few years to recover from the 97/98 Asian financial crisis. The pandemic we’re seeing today is on a scale much larger than that.

So break your piggy bank. But keep some for later.

If you feel that the situation is taking a toll on your mental health, read THIS instead.