If you read the Malaysian news very often, you might spot a certain topic that keeps popping up over and over again. Even when the headlines are filled with war or floods or politics, this topic will inevitably reappear sooner rather than later, like an annoying itch on a spot you just can’t reach. We could be facing a zombie apocalypse, and I’m sure this topic would still be appearing on the second page.

I’m talking of course, about scams.

More specifically, I’m talking about how so many Malaysians seem to fall for scams. Why does it seem like there’s a new “scam victim” style article every day? What is it about our country that seems to attract so many scammers? How could so many rakyat fall victim for such simple tricks?

And most importantly, how can you avoid becoming yet another statistic on that list?

“I don’t need to worry because there’s no way I’d ever fall for a scam!”

First of all, anyone who says this is either an idiot or a scammer themself. Seriously, this just sounds like the dumbest form of anti-vaxxer logic. “I don’t need to take a vaccine because I’d never get sick with COVID-19!”

Newsflash: the virus doesn’t care about how smart you think you are, and neither do scammers.

According to Deputy Home Minister II Datuk Jonathan Yasin, between 2019 and 2021 there were a total of 51,631 online scam incidents resulting in a total loss of RM1.61 billion.

It doesn’t matter how rich or well-connected you might be — anyone can fall victim to a scam if they’re not prepared. In May 2022, a local billionaire lost a total of RM21 million to a simple Macau scam! The worst part? The bank staff actually warned him that he might be getting tricked, but he refused to believe them.

“Who said I’m being deceived?” he reportedly responded. “You are (the one deceived)!”

Malaysian Scammers Are Evolving

Local scammers have advanced past badly spelled Nigerian prince emails or “Insert Your Bank Details to Collect Your Prize!” style scams. You can still find such activities, but many scammers have developed more… sophisticated ways of parting innocent victims from their cash.

For example, let’s take the Case of the Shiny Watch That Costs More Than My Car.

The Case of the Shiny Watch That Costs More Than My Car

In May 2022, a Kuantan businessman known only as Andy was looking to sell his old watch.

But this wasn’t any old watch, oh no. This was a limited-edition Rolex Explorer II luxury watch worth more than RM50,000!

Personally, I have no idea why anyone would pay that much for a watch when you can just use your phone whenever you need to check the time, but that’s a whole other topic.

In any case, Andy put out an advertisement to sell the watch on Facebook. Crazily enough, he actually managed to find someone willing to put down that much cash for a watch (Seriously though. WHY???).

“The buyer, who lives in Kuala Lumpur, introduced himself as Sen and expressed interest in purchasing the watch,” said Andy. “Concerned that Sen might not turn up, I told him to pay for my transportation from Kuantan to Kuala Lumpur and he deposited RM200.”

After traveling to KL, Andy met Sen to do some in-person haggling. After arguing about some minor defects on the watch, he agreed to part with it for a bargain price of only RM49,000. However, that’s where things started to get sketchy…

“The buyer told me to follow him to his luxury condominium in the town centre as his wife was responsible for handling his finances. I was quite concerned but obliged and followed him to the unit to complete the deal.“

“When we reached his unit, the man paid RM4,000 cash and told me that he will transfer the remaining RM45,000 through online banking. Minutes later, Sen showed me a receipt as proof that he had completed the process to transfer the RM45,000,” he said

However, Andy realised that Sen had sent the money through Interbank GIRO rather than instant transfer. They called the bank in order to cancel the transfer, only to be told that it wasn’t possible.

“I suspect the bank employee was also a syndicate member as he told us that since it was already past 5pm, the transfer could not be cancelled. Sen assured me there was nothing to worry about and the cash would be in my account around 11pm the same day,” said Andy.

Believing that it was an honest mistake, Andy agreed to give Sen the watch and go home to Kuantan immediately. Unfortunately, after checking his bank account Andy realised that the money had still not appeared.

“When there was no cash as promised in my bank account, I tried calling the man about 11pm but he had blocked my number,” he said, adding that he believed that the RM45,000 bank receipts he’d received were forgeries printed by other syndicate members.

To put it simply, the scammer known as Sen had paid RM4,200 in exchange for a watch worth RM50,000.

Have You Seen This Watch?

Fortunately, Andy has handed the police a picture of the suspect as well as the address of the condominium where he is believed to be staying. However, given Sen’s head start, it might take a long time for him to get caught — if he ever is.

Andy warned other Malaysians to stay vigilant for similar scammers, especially if they’re trying to sell luxury goods online.

“This is a well-organised syndicate who lay out their plans perfectly to cheat their victims. They are prepared to invest a small sum of money on the victim as long as they can reap bigger profits,” he said.

Note: If you ever come across a Rolex Explorer II watch with the serial number 407DY240, contact the police immediately to report Andy’s stolen property.

But Not All Scams Are So Expensive

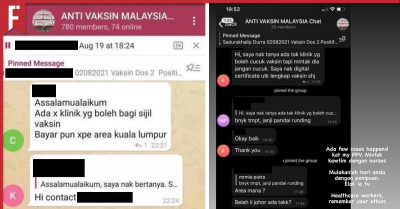

In fact, one of the newest scams going through Malaysia today involves only RM20!

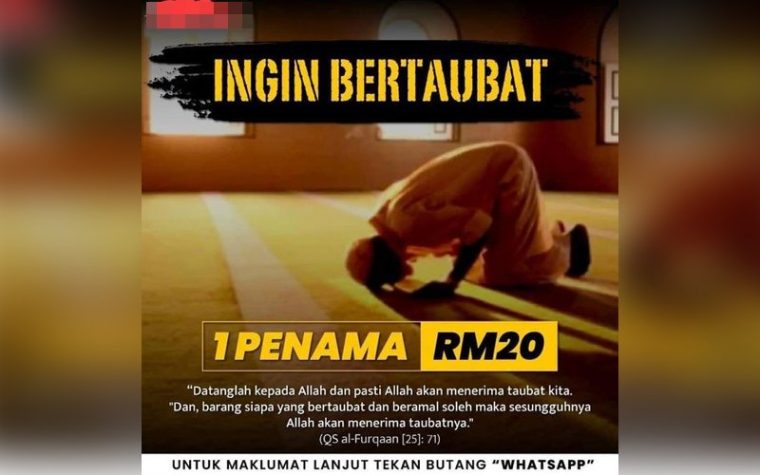

In April 2022, Malaysia’s Islamic religious departments announced that they were investigating a “pakej taubat (repentence package)” being offered on social media.

To put it simply, these scammers would send a message to Muslim citizens offering to help “cleanse their sins” for the small fee of… RM20. Yes, that’s right. For the cost of a venti Starbucks frappe, you too can repent your sins and go to heaven!

I’m joking, of course. Comparing Starbucks drinks to repentance is wrong — mostly because the Starbucks drink actually costs more nowadays. As such, coffee lovers must make a difficult choice between a refreshing drink or eternal damnation.

Not everyone is amused by this situation, however. In particular, Kelantan Mufti Datuk Mohamad Shukri Mohamad has called for the scammers to cease immediately.

“Repenting by individuals (for their sins) should be made directly with Allah, but with fellow human beings, we need to seek forgiveness if we’ve done something wrong to them,” he said.

“In seeking forgiveness from God (Allah) and repenting, there is no payment to be made by individuals who themselves know their own mistakes and those taking advantage of others are ignorant of this fact.”

Don’t Be A Victim

I know we like to point and laugh at how stupid these scams look from afar. But the people who get targeted by these scammers are facing some very real problems. It’s easy to talk big when it happens to someone else, but I assure you that these scams will feel very different when you’re personally involved.

Here are a few simple steps that you can take to protect yourself from scammers:

1) Your Personal Information Should Remain Personal

Never, ever, reveal personal information such as your bank account number or credit card details.

Scammers will often pose as police to try to make you panic, so if you get a call like this you should inform them that you’ll only hand over private information in person at a police station. If they refuse or attempt to threaten you with things like arrest or “investigation”, just hang up immediately.

Remember: The police will NEVER ask you to pay a saman or other fine via ATM or by depositing money into some random bank account. They will always ask you to come in person.

2) Don’t Be Afraid to Perform Background Checks

If you get a call from someone claiming to be a government official, it’s important to do a background check and verify their identity.

If they are a real policeman, they are required to inform you of information such as their:

- Full name

- The police station where they’re based

- Identification number

- Name and details of their superior officer

This also applies if the caller claims to be from a bank or company. Never trust them until you’ve verified that they are really who they say they are.

3) Love Online? Get Real

Go to any dating app or social media platform and you’ll probably find tons of hot, single young men or women who would totally be interested in going out with you. All you have to do is help them out with a liiiitle bit of money first…

Look, I’m going to be honest here: that cute girl who claims to be totally into you but keeps asking weird questions about your finances is almost certainly some fat sweaty middle-aged dude sitting in his mum’s basement.

To avoid getting catfished, never give money to someone you’ve met online — even (or especially) if you love them. After all, would a person who really loved you ever try to extort money from you?

So Many Scams, So Little Time

Scams can happen to anyone. Yes, even you.

In order to avoid becoming a victim, it’s important to practice constant vigilance and keep up to date on these scammer’s latest tricks and schemes. If you’re interested in learning more about some of the more common scams in Malaysia, be sure to check out:

7 Scams You Never Realised You Fell For