It all started with a simple call from a number that I didn’t recognise. As an eternally exhausted, sleep deprived university student, I assumed that it was just one of my classmates wanting to talk about our group project or something.

“Maaf ya, encik… saya dari MACC ya… saya call sebab account kamu ada problem…”

A half-hour later, I hung up, significantly more worried than before. When I got home, I asked my mum if there was a way I could check my bank account number.

“Why?” she asked.

“Because someone called and asked me about my bank account number earlier today and got mad when I couldn’t remember.” I replied, terrified that some policeman would soon come knocking on the door to drag me away.

And that’s when my beloved mother, the one who brought me into this world and raised me with all the love and care in her heart, looked me in the eyes and said “Are you an idiot? That’s a scam, lah!”

Malaysia: The Scam Capital of Asia?

Today, the average Malaysian is no stranger to scams.

In fact, in 2019 an app called Truecaller reported that based on their analysis, Malaysians receive the biggest percentage of scam calls in the world. Out of over 90 million spam calls detected that year, no less than 63% were classified as fraudulent scams.

The scam situation here has gotten so bad that even other countries are starting to pay attention.

Before the pandemic kicked into full swing, the U.S. Embassy in Malaysia actually put up a ‘Scams FAQ’ page on their site to warn American travellers about the problem — calling Malaysia “the number one internet scamming hotspot in Asia” as our “relaxed immigration policies” and “advanced IT infrastructure” makes it easy for scammers and syndicates to set up shop.

How COVID-19 Caused Our Conmen to Evolve

COVID-19 has caused plenty of problems for Malaysians. Since the first local cases were detected last year, we’ve all had to go through lockdowns, travel restrictions, mental health issues and more.

But there is one particularly insidious problem brewing in the background that many of us haven’t noticed: scams.

During the lockdown period, reports of scams exploded as frightened, desperate people were left isolated in their homes — making them far more vulnerable to scam artists.

“Right now, everyone is heavily reliant on their laptops or mobile phones to conduct their everyday needs such as online banking, shopping or donating to causes and charities. Criminals are not afraid to take advantage of that,” said Tan Kim Chuan, Head of Forensic at KPMG in Malaysia.

As of 4 August 2020, the government revealed that there had been up to 2,500 reported fraud cases since the start of MCO, causing losses of up to RM17 million across the country.

7 Common Scams in Malaysia (And How to Avoid Them)

Nowadays, scam artists have developed more sophisticated ways of getting people to hand over their sweet, sweet bank account details. During the MCO period, there were many new types of scams reported, some of which had never been seen before.

Read on below for a list of common scams and the best ways to avoid getting caught in them.

1) Macau Scam

This is one of the most common scams in Malaysia, and the one I could have fallen for myself, if it wasn’t for my own bad memory.

According to Bernama, no less than 1,420 Macau scam cases were charged in court between January and October 2020, involving losses of around RM256 million in total.

This scam involves someone posing as a policeman or bank officer. The scammer will call the victim, then make some grandiose-sounding claim about how they’re a suspect in a money laundering case. Alternatively, they may also claim that the victim has some kind of outstanding loan or fine that needs to be paid off immediately.

The details of the story will change, but the goal is always the same — to get the victim to panic and transfer money into the scammer’s bank account to “avoid getting into trouble”.

How to avoid:

Just hang up.

I’m being serious. It doesn’t matter if the person on the phone claims to be a policeman, a banker or even a Datuk, if the conversation includes specific instructions about sending money over the phone, odds are that it’s just a scam.

Besides, do you really think that the police would just call a suspect on the phone like that? Even if you somehow became a suspect in a case, they’d just go straight to your house and speak to you in person.

2) Fraudulent Health Products Scam

As the pandemic got worse, demands for healthcare-related items such as face masks surged, drawing the attention of scammers all across the nation.

During the first MCO, Deputy Inspector-General of Police Datuk Mazlan Mansor reported that there had been 393 fraud cases involving the sale of face masks nationwide, with losses totalling up to RM1.1 million. Most of the cases involved people who attempted to buy face masks online, only to realise that they’d been duped when the product never arrived.

Aside from face masks, another common version of this scam involves the sale of fake and unregistered drugs, some of which claim to be ‘miracle drugs‘ that can cure COVID-19.

How to Avoid:

If you need to get more face masks, buy from a reputable seller such as a pharmacy or a supermarket instead of trusting anonymous ‘suppliers’ online.

Aside from that, don’t take medical advice or buy drugs from random people on the internet. If you truly have some kind of health issue, you should contact an actual doctor instead.

3) Investment Scam

Bogus investment schemes are another common scam in Malaysia. These scammers tap into people’s greed by promising them easy money and luring them into get-rich-quick schemes.

Last year, the Securities Commission Malaysia (SC) cautioned the public to be careful with their money following a rise in fraud cases linked to unregistered companies.

“Investors who deal with unlicensed or unauthorised entities or individuals are exposed to various risks, including fraud and money laundering, and may not have access to legal recourse in the event of a dispute. The SC reminds investors to only trade with Recognised Market Operators (RMOs) that are registered and authorised by the SC,” they reminded.

How to Avoid:

Before investing your money, make sure to check out SC’s Investor Alert List. This page contains a list of suspicious and unauthorised companies that you should stay clear of.

Make sure to do your own research and plan carefully before pouring your money into an investment — if it seems too good to be true, it probably is.

4) Job Scam

This particular type of scam became more prevalent as more and more people lost their jobs or began working from home for the first time.

A job scam is when a scammer places a fake job ad online, usually promising high pay for little work. When someone applies for the job, they will be asked to make a payment before getting any work. In some cases, they’ll ask you to pay before they’ll even start the interview!

The desperate victims are strung along for as long as possible with the promise of good pay and benefits once they get ‘confirmed’.

By the time they realise the trick, some of them have already poured in all their savings — one particularly prominent case happened in September 2020 when a group of 18 Malaysians lost a total of RM180,025 to a man who promised to get them jobs at a casino in Cambodia.

How to Avoid:

One of the big warning signs of a job scam is if they try to request money in order to ‘confirm’ the job offer or interview. Most legitimate companies will not charge you money just to apply for a job — after all, they’re trying to attract more employees, not scare them away!

Another red flag is if the company refuses to do any face-to-face interviews. Though admittedly this is less damning in current times, a company that refuses to do even a video interview is definitely suspicious.

Aside from that, before you apply for a job make sure to do research on the company first. Not only will this help you confirm whether or not it’s a legit company, but doing some prior research can also help you make a better impression during the interview.

5) Fake Government Aid Scam

During the first MCO, Bantuan Prihatin Nasional (BPN) was sent out to thousands of B40 and M40 Malaysians all across the country as a form of financial aid during the lockdown.

Unfortunately, this also attracted the attention of grifters and scam artists who sought to take advantage of the situation. The most common version of this scam involved sending a text message claiming that you were qualified for BPN aid and asking for bank account details so that they could ‘deposit the payment’.

However, when the victims checked their bank accounts the next day, they found no payment at all. In fact, in some cases, their accounts were cleared out!

How to Avoid:

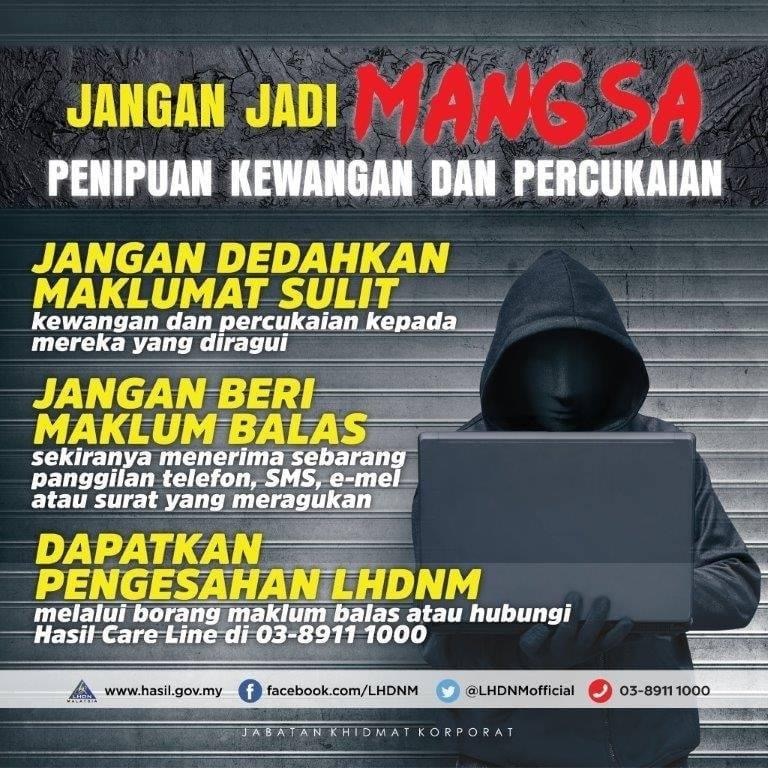

First, check the number. The Inland Revenue Board (LHDN) only sends text messages from the numbers 62000 or 63833, so if the number is different that means it’s a fake. If it’s an email, the address should be “no_reply@hasil.gov.my”.

Aside from that, whether it’s text messages or email, LHDN will never ask for personal details such as full names or banking information. If you’re worried about whether or not you qualify for government aid, just go to the LHDN website or Semak Prihatin to confirm directly.

6) EPF Withdrawal Scam

Remember when the government announced that people could withdraw money from their EPF accounts during the lockdown?

Well, it turns out that most people had no idea how to actually do that, which caused a new type of scam to appear.

“Scammers started making various ‘offers’ on social media platforms when the government had announced to the public that they can withdraw their EPF savings,” said Senior Minister (Security Cluster) Datuk Seri Ismail Sabri Yaakob. “The scammers tricked victims into surrendering their identification cards and bank account details on the pretext of assisting them to withdraw their EPF savings.”

How to Avoid:

Don’t trust anyone with your personal details, especially if they’re just some random person on social media. If you plan to withdraw money from your EPF account, you should go directly to their official website instead.

7) Casanova Scam

Another classic trick, the Casanova or Love scam is relatively old, but that makes it no less devastating to its victims. Despite what some might assume, this scam has been used on both men and women — the scammers will go for people who are feeling lonely and desperate for companionship regardless of gender.

With this type of scam, the victim is approached by someone through social media and lured into an online relationship. The scammer won’t ask for money immediately, but will instead wait until they think they have the victim’s trust. In fact, they usually spend weeks wooing their victim, sometimes even ‘confessing’ their love very early on in order to get the victim to let down their guard.

Eventually, the scammer will inform the victim that they need money. Perhaps it’s for an emergency or they’ve sent a gift that happens to be stuck with the Customs Department, Immigration, etc.

Regardless of the excuse, the victim will be asked to send over their money. In some cases, the victim will end up paying thousands of ringgit before getting ghosted.

How to Avoid:

One common theme with these types of scams is that the scammer will usually try to avoid meeting you in person or via video communication. If your online date partner refuses to even show their real face, how can you trust them?

Another feature of Casanova scams is that the victim will be asked to transfer money to someone’s personal bank account, even one that might be outside of Malaysia. If you’re not sure of the account’s authenticity, Jabatan Siasatan Jenayah Komersil (Commercial Crime Investigation Department) has actually set up a portal that you can use to check on mule accounts.

Don’t Let Yourself Become a Victim

Modern technology has brought us so many benefits. Today, I can order food from anywhere in KL, speak with someone halfway across the world and even pay all my bills with just a few taps of my phone.

But all of this convenience comes with a downside. As technology has grown more and more advanced, so too have scammers grown and evolved to take advantage of it.

If we want Malaysia to stop being known as the scam capital of the continent, we cannot afford to remain complacent. In order to reduce the number of scam victims, we need to tackle issues such as high corruption and lack of information. By making it harder for scammers to function, we can make our country a better, safer place to live.