In life, only two things are certain: death and taxes.

Most of us treat these two topics pretty similarly. We don’t like to talk about it, we don’t want to think about it and we generally do our best to ignore it… even as it looms closer and closer over time.

But while death is something that you can’t escape no matter what, taxes are something that you can — and should — be prepared for.

Income Taxes 101

The last time I was in university, there were unfortunately no classes labelled “Income Tax 101”. It’s one of those “adulting” things that we’re all supposed to magically know once we graduate, like making babies or buying houses and all that jazz.

To keep it simple, income tax is based on the amount of income you earn. In other words, more money = more taxes.

Before you start, you need to look at your income. If you’re earning more than RM34,000 a year (that’s RM2,833 a month), then you need to pay taxes.

However even if your paycheck isn’t that high, you still need to do some paperwork!

According to the Inland Revenue Board of Malaysia (LHDN), anyone who has an annual income of more than RM25,501 a year (about RM2,125 per month) after EPF deduction still has to register a tax file and declare their income.

Bear in mind that taxable income includes all your income, not just the money you get from your job. So if you’re renting out a property or something, the money you get from that is also counted.

Aiya, So Mafan One. What If I Too Lazy To File?

TLDR: you don’t file properly, you get big saman.

If you get caught by the LHDN’s auditor, you can face a penalty of up to 300% of the taxable amount. So if your original tax was just RM500, now you owe the government RM1,500.

And that’s not even including the additional punishments based on the Income Tax Act of 1967. According to the act, “failure (without reasonable excuse) to furnish an Income Tax Return Form” can be punished with a fine of RM1,000 to RM20,000 and/or imprisonment!

It’s important to declare your income even if you’re not in a high enough pay bracket. Even if you’re not taxable at the moment, you might still be eligible for other tax returns.

Okay, Okay. I’ll Do It. But How to File My Income Taxes?

Unless LHDN announces otherwise, you can start submitting your income tax return forms online starting from 1 March every year. You can still do it manually if you really want, but the e-Filing system has grown much more popular over the last few years.

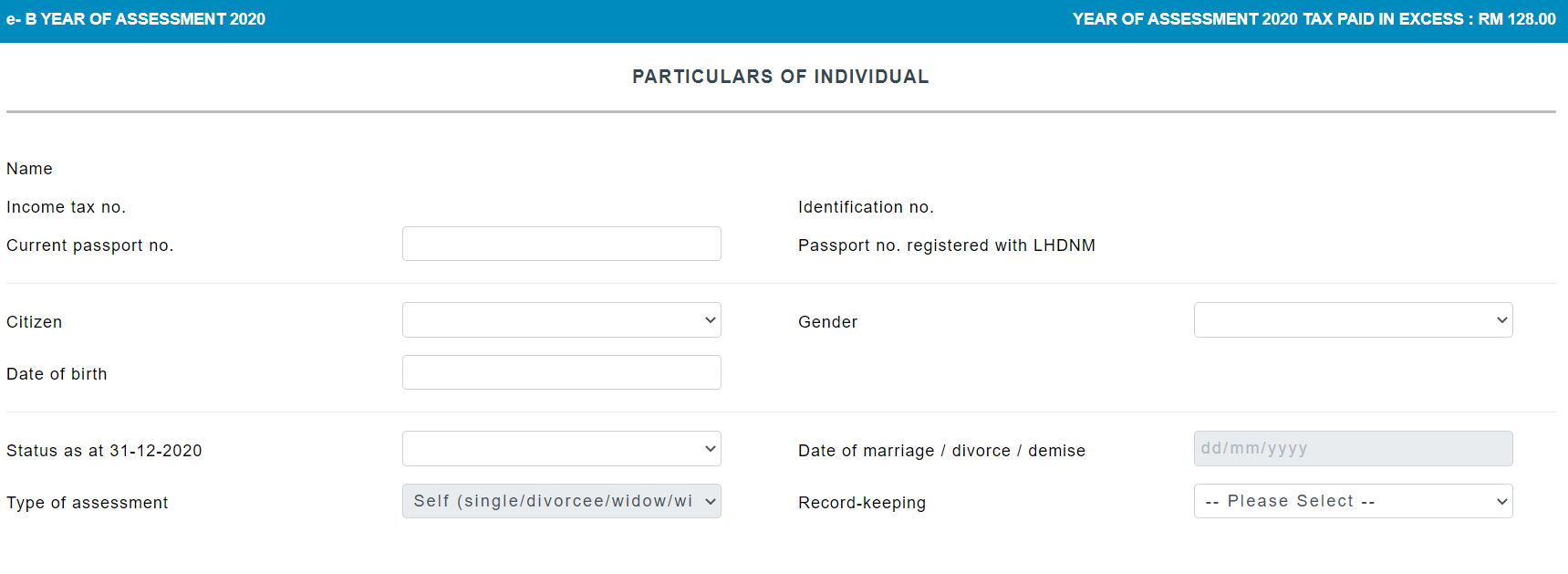

If this is your first time, then you’ll need to register at the e-Daftar website with a copy of your identification card/passport. After you’ve registered, you’ll need to apply for a PIN number at the nearest LHDN branch for your first time login.

And yes, it is a bit annoying that you have to go there in person, but you only have to do it once. After you’ve got your PIN number, you can just go to the ezHASIL site and do the filing online.

Once you’re logged into the ezHASIL site, simply click on e-Filing in order to fill in and submit your Income Tax Return Form (ITRF). Here’s how it works:

Step one: fill in your personal details.

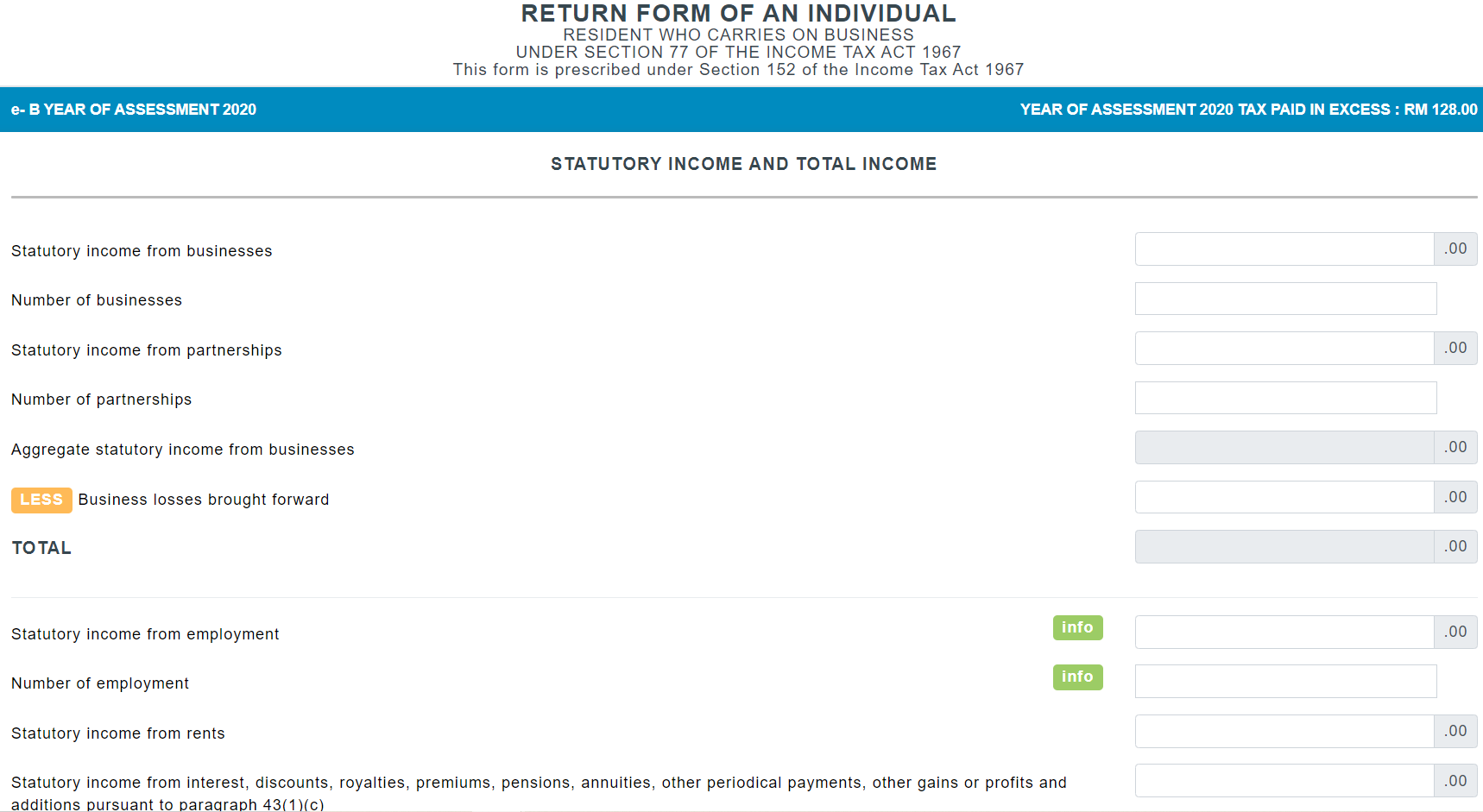

Step two: Enter your income. If you’re not a business owner, just skip that part and go straight to the employment income.

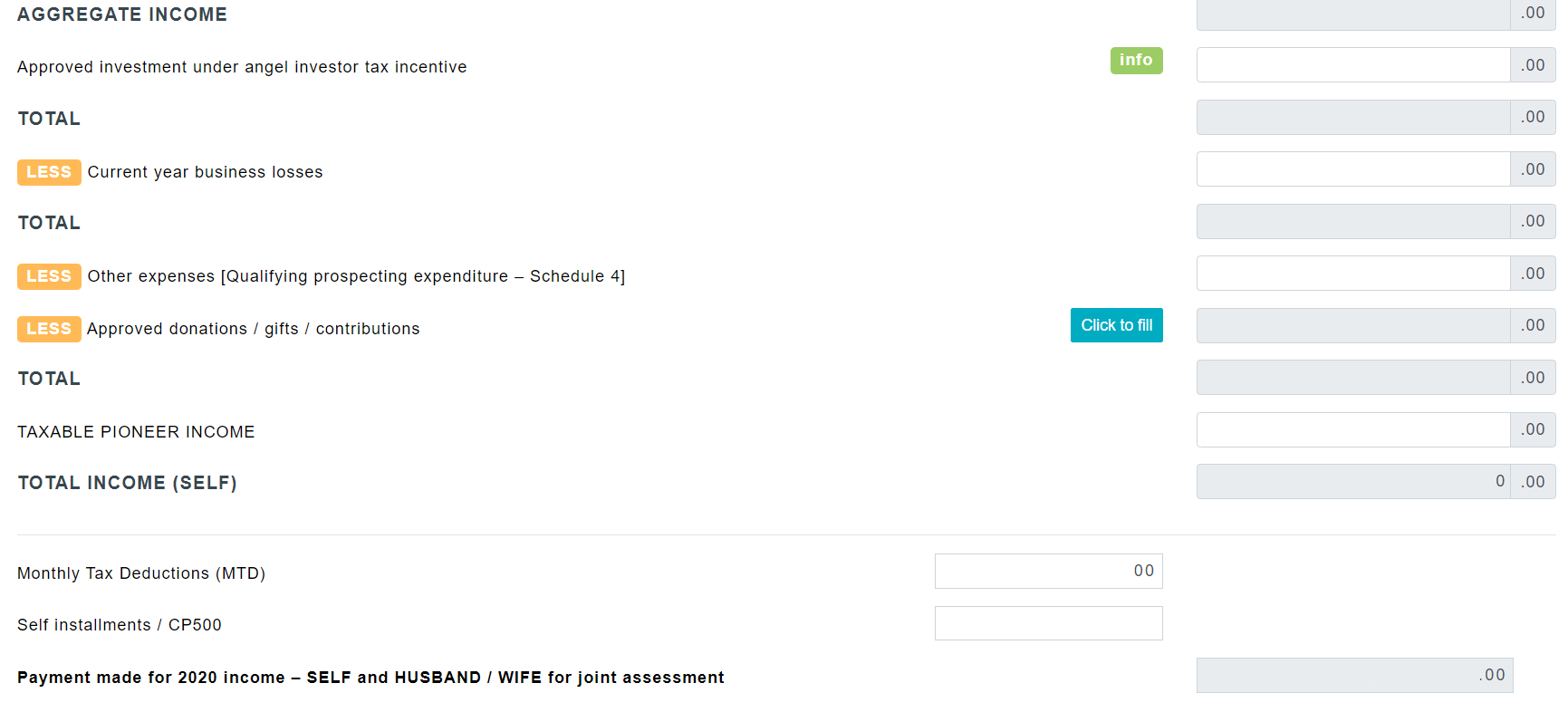

Step three: If you’re a business owner or investor, make sure to include your earnings or losses here.

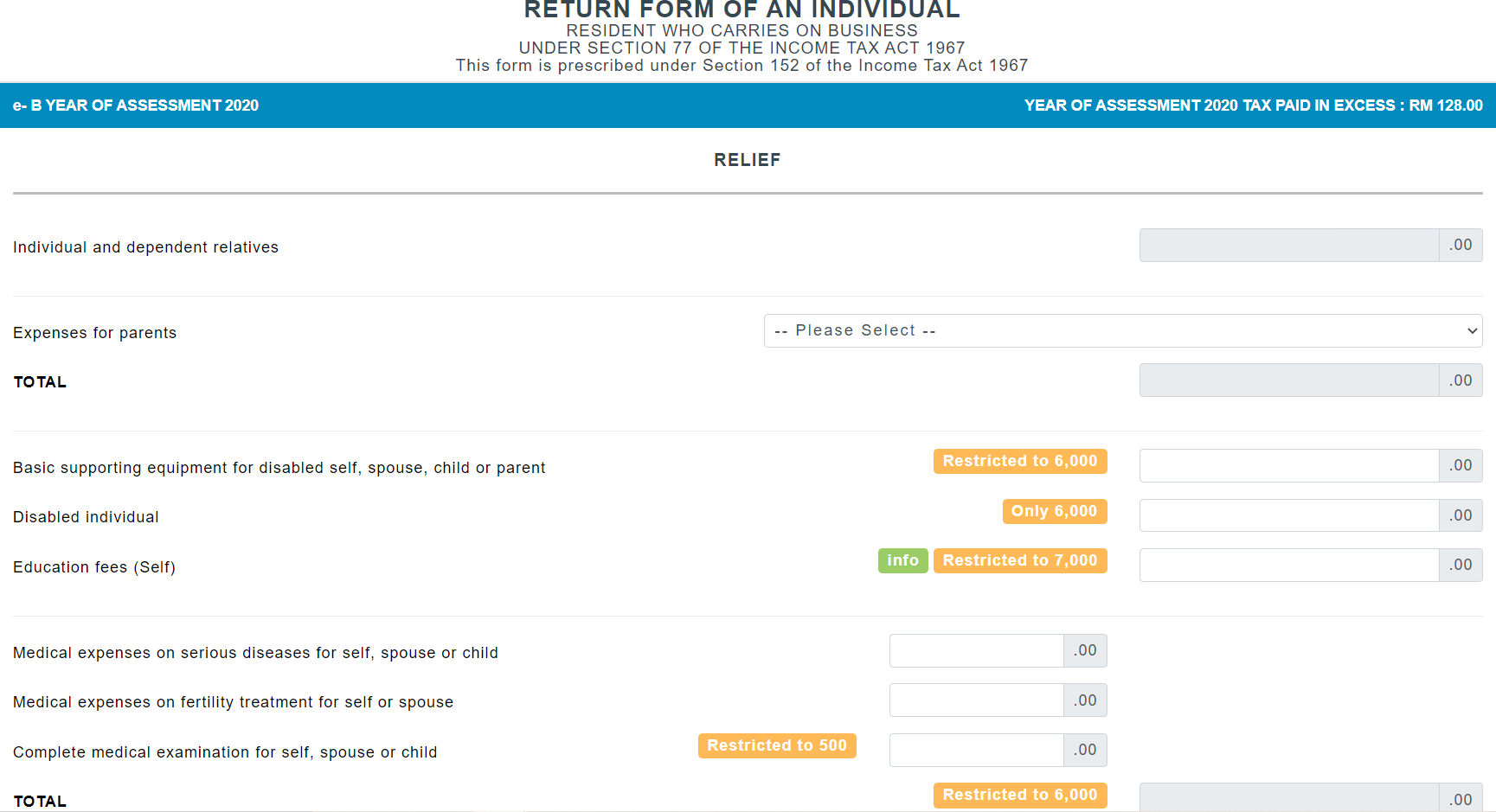

Step four: Fill in all your exemptions, reliefs and rebates. Make sure to keep the receipts for up to seven years as proof for anything you claim.

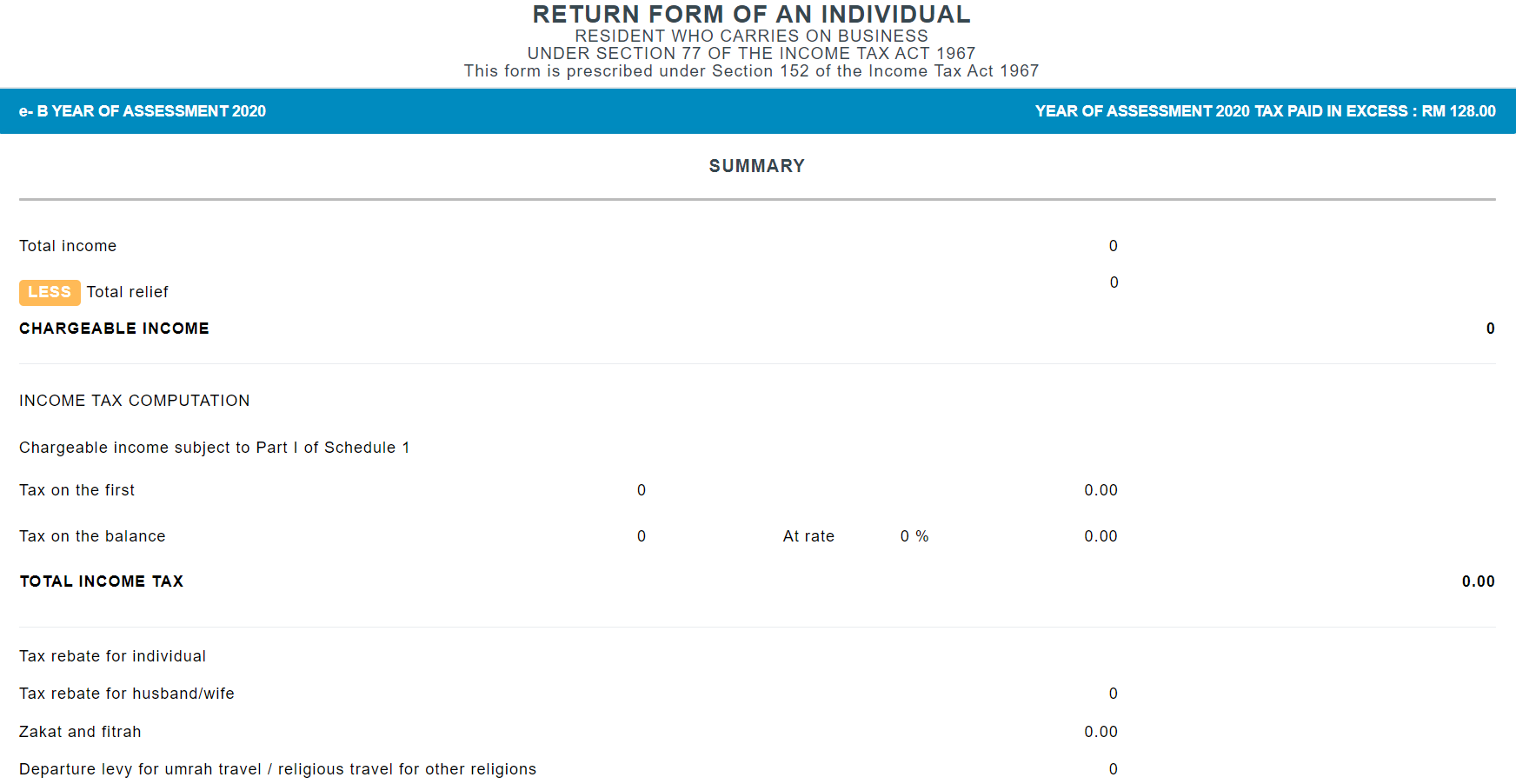

Final step: The system will calculate everything for you, so just double check to make sure that all the information you’ve put in is correct. Once you’re done, all you have to do is put in your electronic signature and send it off.

You will need to have the following documents ready to complete your tax return:

-

Statement of Remuneration (EA form) which should be provided to you by your employer

-

Income Statement for your sole-proprietorship business (if you’re a business owner)

-

EPF statement, receipts, etc. (if you plan to claim personal reliefs and rebates)

-

Any documents or receipts linked to any other income that you have earned (property rental, book royalties, etc.)

The nice thing about doing e-Filing is that the online tax form will calculate everything for you automatically. As long as you fill in all the information properly, there’s no need to try to figure all the numbers yourself.

But How Do I Pay My Taxes?

Fortunately, once you’ve filed everything, the actual payment is pretty straightforward. LHDN provides a number of ways for you to pay your taxes — so there’s no excuse for not paying on time!

If you’re living in Malaysia, here are the most commonly used methods to pay individual taxes:

1) Online

The quickest and simplest method involves logging into the ByrHASIL portal. As the official LHDN payment site, you can pay your taxes via FPX or credit card (including Visa, Mastercard and American Express).

Just note that credit card payments will include a 0.8% processing fee.

2) Over the Counter

You can pay your taxes manually by heading over to the nearest bank or Pos Malaysia branch. The list of eligible banks are:

-

CIMB Bank

-

Public Bank

-

Maybank

-

Affin Bank

-

Bank Rakyat

-

RHB Bank

-

Bank Simpanan Nasional

Note that Pos Malaysia outlets will only accept cash payments.

3) ATM and CDM

The ATM service is only available at three banks:

-

Public Bank

-

Maybank

-

CIMB Bank

You simply need to have an ATM card from the respective banks as well as your income tax reference number.

The cash or cheque deposit machine (CDM) can also be used to pay your taxes, but only at Public Bank (cheque) and CIMB (cash).

Paying Taxes is Important

Paying taxes can feel painful — after all, nobody likes to see their hard earned money disappearing. However, paying taxes properly is one of our most important duties as a citizen of Malaysia.

The money that the government collects from taxes is important for keeping our society running. This tax money is used to pay for all sorts of public services including road maintenance, healthcare and education.

Our government punishes tax evaders heavily because such selfish individuals are not only breaking the law but also taking advantage of the hard work of everyone around them.

So while dealing with taxes can definitely be annoying, it is a burden that we should carry with pride. After all, the money we pay in taxes today will be used to transform Malaysia into a stable, developed nation in the near future.